All Categories

Featured

Table of Contents

Here are some kinds of non-traditional living benefits bikers: If the insurance holder outlasts the term of their term life insurance, the return of premium rider guarantees that all or component of the costs paid are gone back to the policyholder. This can appeal to those that desire the guarantee of obtaining their cash back if the plan is never used.

The insurance company will certainly either cover the costs or forgo them.: The ensured insurability rider enables the policyholder to buy added insurance coverage at certain intervals without confirming insurability. Helpful for those who anticipate needing much more insurance coverage in the future, especially useful for more youthful policyholders whose demands could enhance with life events like marital relationship or giving birth.

Where can I find Riders?

Using economic alleviation throughout the uncomfortable event of a kid's death, covering funeral expenditures, and permitting pause work. The cost of living modification cyclist aids to guarantee that the plan's advantages are shielded from inflation to make sure that the survivor benefit remains according to the increasing living costs. if the policyholder comes to be impaired and can not work, the Disability Revenue Motorcyclist supplies a monthly earnings for a given duration.

Instead of focusing on assisted living home or helped living centers, the Home Health care Rider offers benefits if the insured calls for home health care services. Enables people to get treatment in the convenience of their own homes. In situation of a divorce, the Divorce Defense Rider enables adjustments in policy ownership or beneficiary designations without needing the consent of the initially called plan proprietor or recipient.

Makes sure the plan does not gap during periods of monetary difficulty due to unemployment. The expense, benefit amount, duration, and particular triggers differ commonly among insurance service providers.

Not every person is automatically qualified for life insurance living benefit plan motorcyclists. The details eligibility criteria can rely on numerous aspects, consisting of the insurance coverage company's underwriting guidelines, the type and term of the policy, and the specific biker requested. Here are some common elements that insurance providers may think about:: Just certain kinds of life insurance policy policies might use living advantages bikers or have them consisted of as common functions.

Who are the cheapest Level Term Life Insurance providers?

: Lots of insurance coverage business have age constraints when including or exercising living advantages cyclists. For instance, a vital disease biker may be readily available just to insurance policy holders listed below a certain age, such as 65.: Initial eligibility can be affected by the insured's health condition. Some pre-existing problems might make it testing to get approved for certain motorcyclists, or they could result in higher premiums.

For example:: An insurance holder might require to be diagnosed with one of the covered essential illnesses.: The guaranteed could have to verify they can not carry out a set variety of Tasks of Daily Living (ADLs). : A physician typically have to detect the policyholder with an incurable illness, having a defined time (e.g., year) to live

How do I choose the right Retirement Planning?

A return of costs biker on a term policy might just be offered if the policyholder outlasts the entire term.: For specific motorcyclists, particularly those associated to wellness, like the vital ailment cyclist, added underwriting may be needed. This could involve clinical tests or in-depth wellness sets of questions.

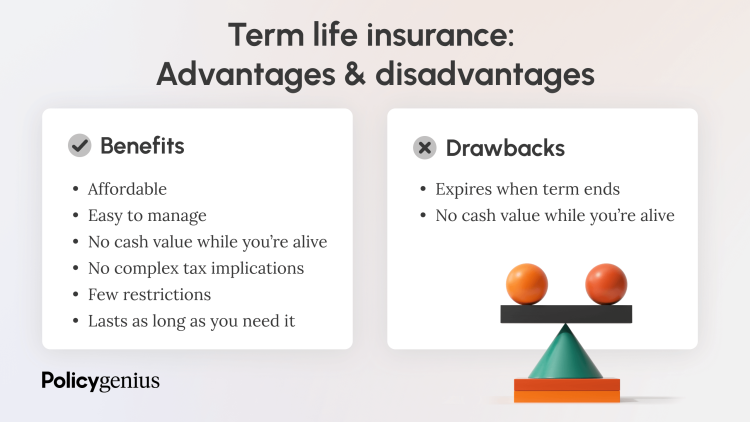

While life insurance with living advantages gives an included layer of defense and flexibility, it's vital to be familiar with possible disadvantages to make a knowledgeable choice. Right here are some potential disadvantages to take into consideration:: Accessing living benefits usually means that the survivor benefit is minimized by the quantity you take out.

What is the best Wealth Transfer Plans option?

: Including living advantages riders to a policy may lead to higher premiums than a typical plan without such riders.: There might be caps on the quantity you can take out under living benefits. For instance, some plans might limit you to 50% or 75% of the fatality benefit.: Living benefits can present additional intricacy to the policy.

While offering a precise dollar quantity without certain details is challenging, here are the regular variables and considerations that influence the price. Life insurance policy business price their products differently based on their underwriting guidelines and run the risk of assessment designs. Age, health, lifestyle, line of work, life expectations, and whether or not you smoke can all impact the expense of a life insurance policy premium, and this carries over into the rate of a biker.

Whether living benefit cyclists are worth it depends on your situations, monetary goals, and risk tolerance. They can be a valuable enhancement for some individuals, however the added expense may not be warranted for others. Right here are a couple of factors to consider to assist identify if it may be best for you:: If your household has a substantial background of health problems, a critical health problem biker might make even more sense for you.

Nevertheless, among the advantages of being guaranteed is that you make setups to place your life insurance policy in to a trust. This provides you greater control over who will take advantage of your plan (the recipients). You appoint trustees to hold the money sum from your plan, they will certainly have discernment concerning which among the recipients to pass it on t, exactly how much each will certainly get and when.

Why do I need Term Life?

Learn more about life insurance policy and tax. It is very important to keep in mind that life insurance policy is not a cost savings or financial investment plan and has no money worth unless a valid case is made.

If you pass away while you are an active participant, your recipient or member of the family should call your employer. The company will assist in coordinating any type of benefits that may schedule. If you die while you are retired, your recipient or survivor must call Securian Financial toll-free at 800-441-2258. VRS has actually acquired with Securian Financial as the insurance provider for the Group Life Insurance Policy Program.

If you were covered under the VRS Group Life Insurance Policy Program as a participant, some advantages continue into retired life, or if you are qualified to retire however delay retirement. Your coverage will certainly end if you do not meet the age and solution requirements for retirement or you take a reimbursement of your participant contributions and rate of interest.

The decrease rate is 25% each January 1 till it gets to 25% of the complete life insurance benefit worth at retirement. If you have at least thirty years of solution credit rating, your coverage can not lower listed below $9,532. This minimum will be enhanced each year based on the VRS Strategy 2 cost-of-living change estimation.

What should I look for in a Retirement Security plan?

On January 1, 2028, your life insurance policy coverage minimizes to $50,000. On January 1 complying with 3 calendar years after your work ends (January via December), your life insurance policy protection reduces a last 25% and stays at that value for the rest of your retired life. Your final reduction will certainly get on January 1, 2029, and your protection will continue to be at $25,000 * for the remainder of your retired life.

Latest Posts

Funeral Advantage Program Cost

Funeral Plans Compare The Market

Sell Final Expense From Home